Working capital is defined as the excess of current assets over current liabilities It forms a part of the aggregate capital of the business Now, a business needs working capital to fund its short term obligations Typically, firms with an optimum level of working capital indicate efficiency in managing its operationsNet Working Capital in Acquisitions On the surface, calculating the net working capital of a company is a basic formula current assets – current liabilities = net working capital, but in M&A transactions, this very simple definition can be a complex, difficult, and important part of the transaction Yes, net working capital is the balance7 Working capital investment levels The working capital ratios shown above can be used to predict thefuture levels of investment (the financial position statement figure)required This is done by rearranging the formulas For example Working capital investment levels The level of working capital required is affected by the following factors

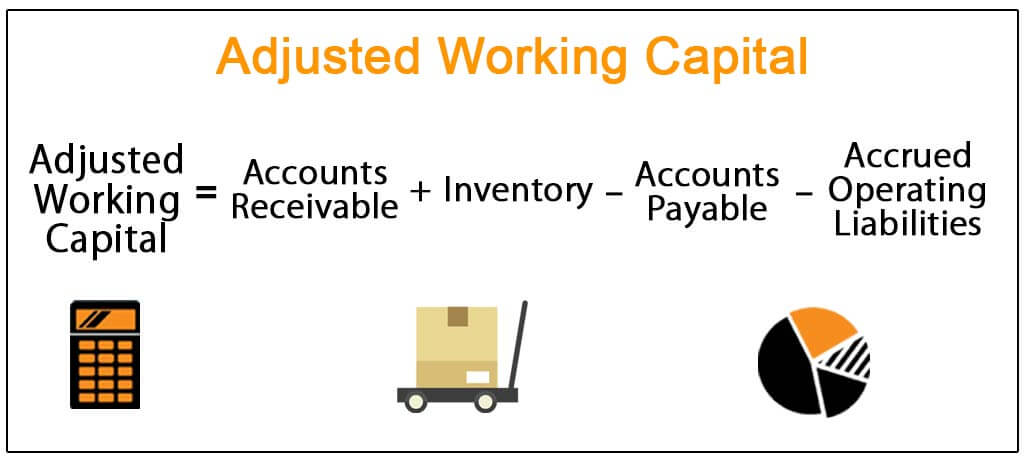

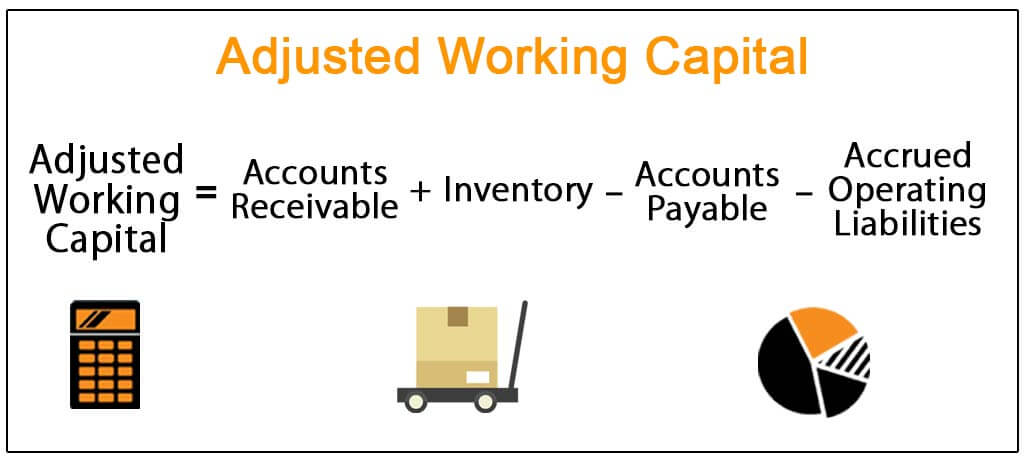

Adjusted Working Capital Definition Formula Example

Level of working capital formula