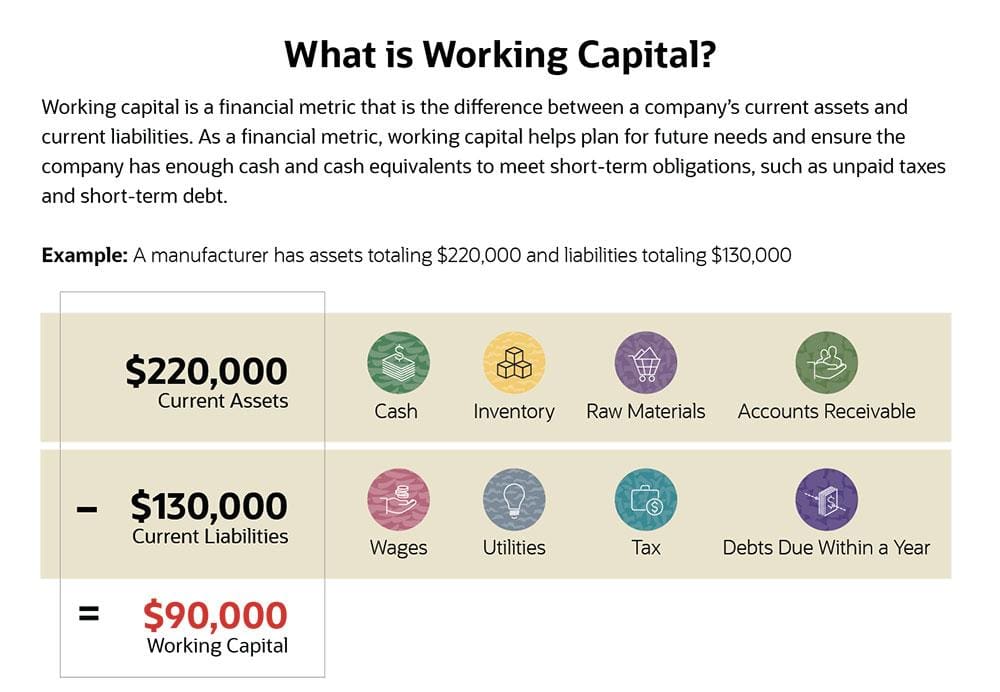

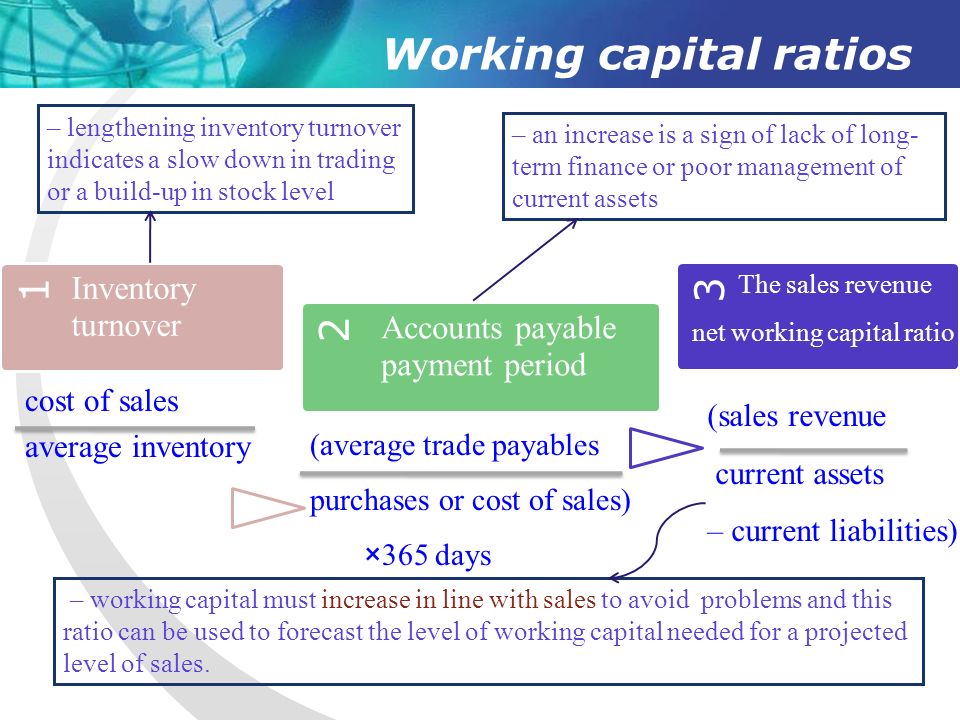

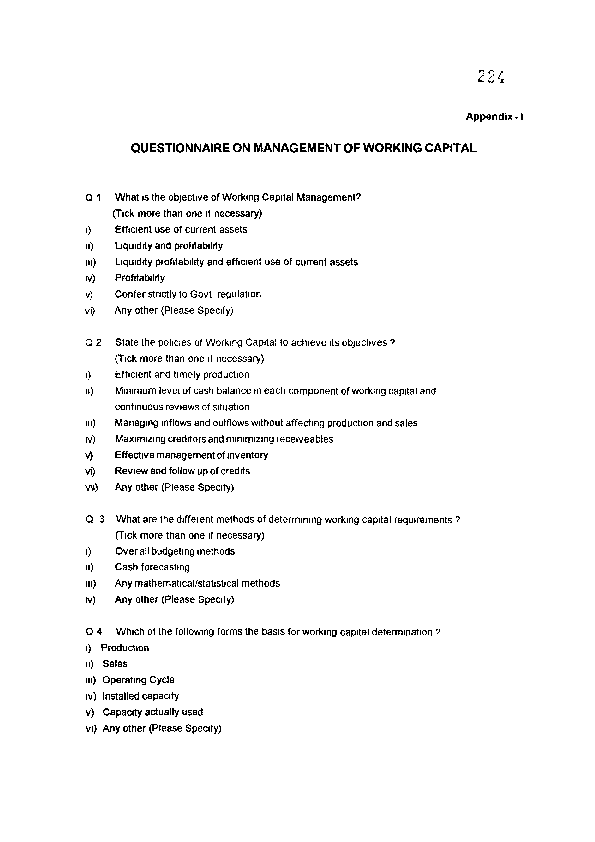

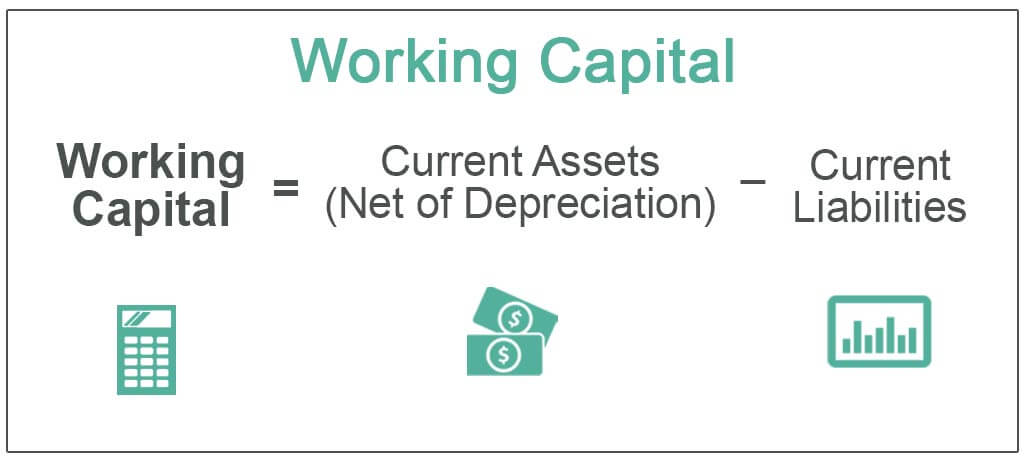

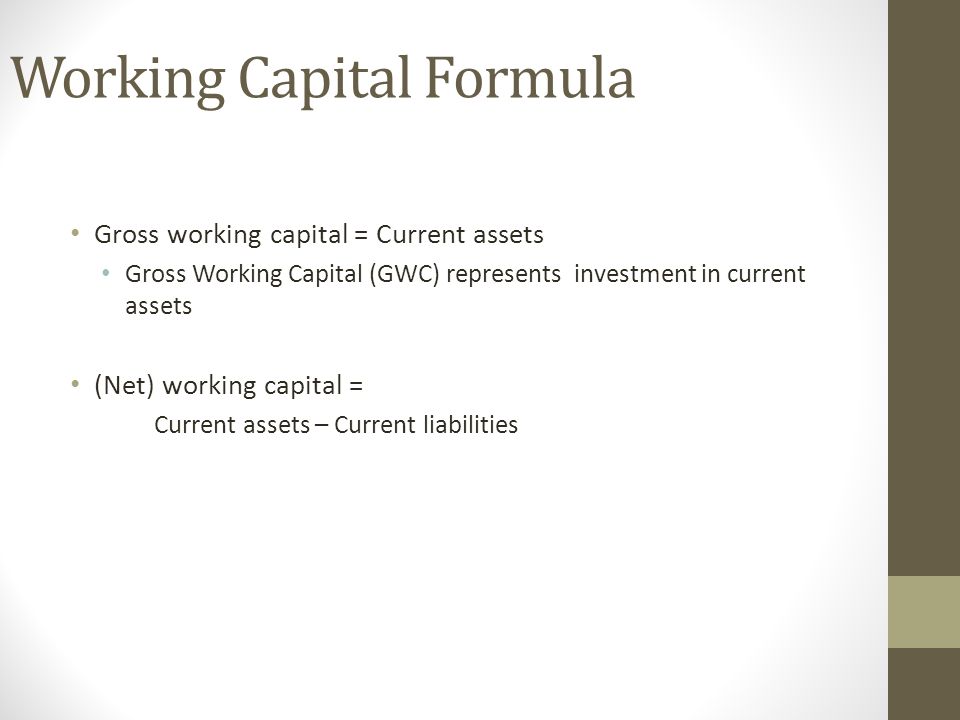

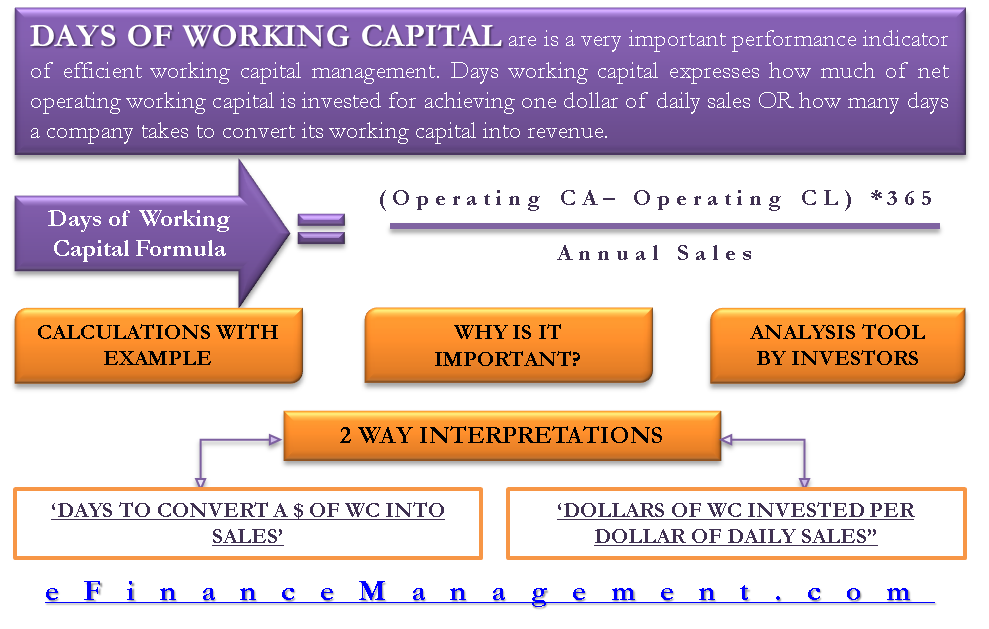

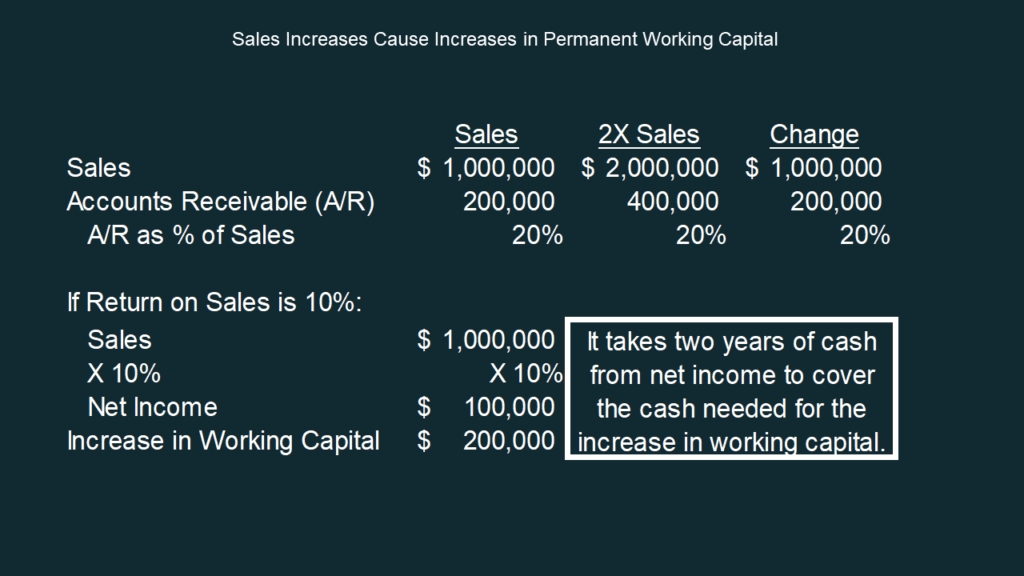

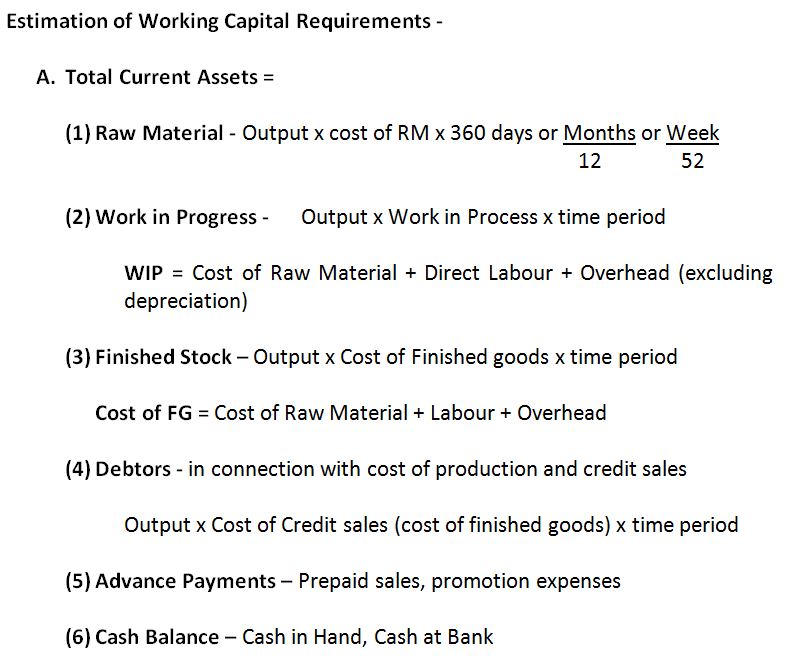

Working capital is defined as the excess of current assets over current liabilities It forms a part of the aggregate capital of the business Now, a business needs working capital to fund its short term obligations Typically, firms with an optimum level of working capital indicate efficiency in managing its operationsNet Working Capital in Acquisitions On the surface, calculating the net working capital of a company is a basic formula current assets – current liabilities = net working capital, but in M&A transactions, this very simple definition can be a complex, difficult, and important part of the transaction Yes, net working capital is the balance7 Working capital investment levels The working capital ratios shown above can be used to predict thefuture levels of investment (the financial position statement figure)required This is done by rearranging the formulas For example Working capital investment levels The level of working capital required is affected by the following factors

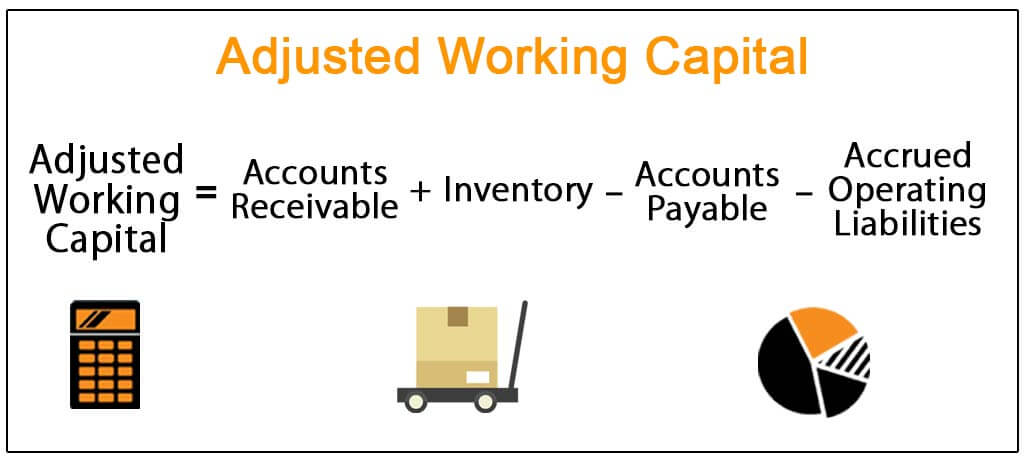

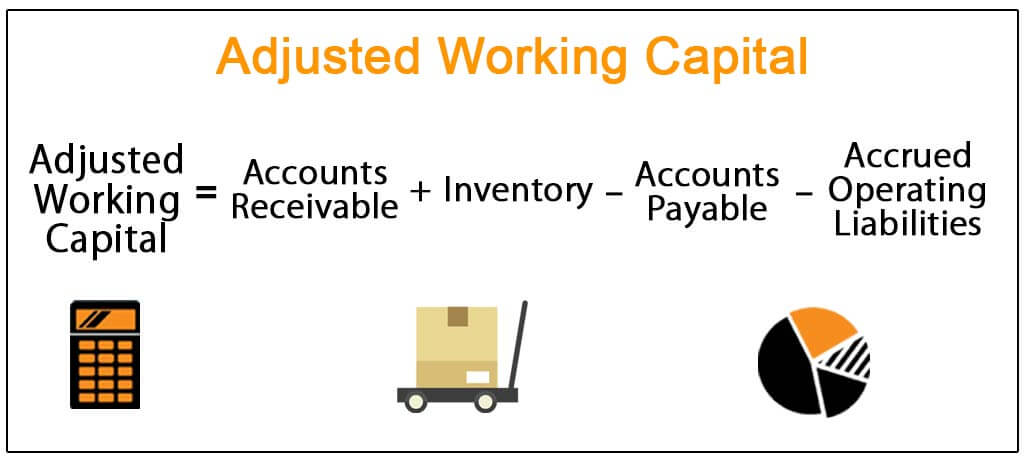

Adjusted Working Capital Definition Formula Example

Level of working capital formula

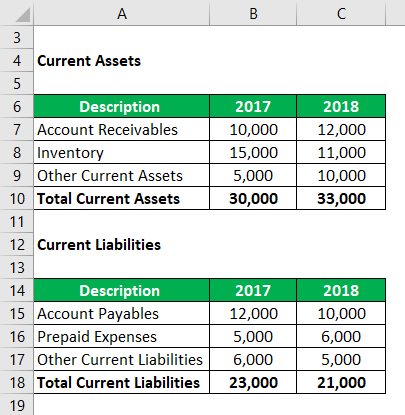

Level of working capital formula- Working capital is a snapshot of a present situation, while cash flow measures the ability to generate cash over a specific period Most businesses with high cash flow will also have high working capital But there can be some divergence depending on things like investments, paying off old debt and paying dividends to shareholdersTo calculate a company's average working capital, the following formula is used (Working capital of the current year Working capital of the prior year) ÷ 2 This indicates whether a company possesses enough shortterm assets to cover shortterm debt Understanding the Working Capital Ratio

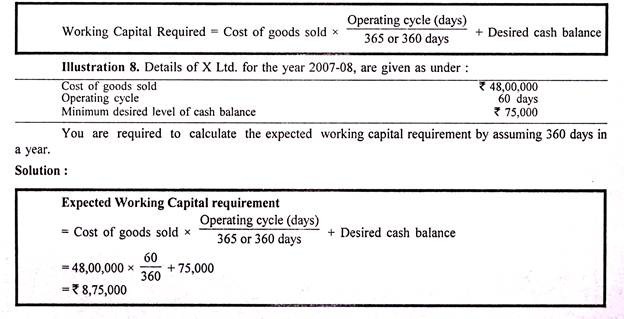

How To Calculate Working Capital Requirement Plan Projections

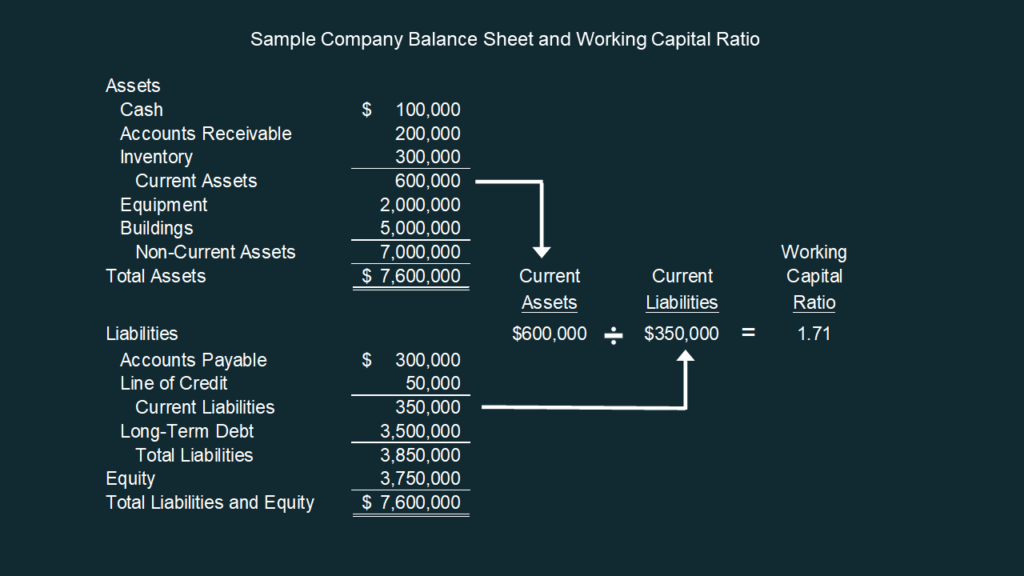

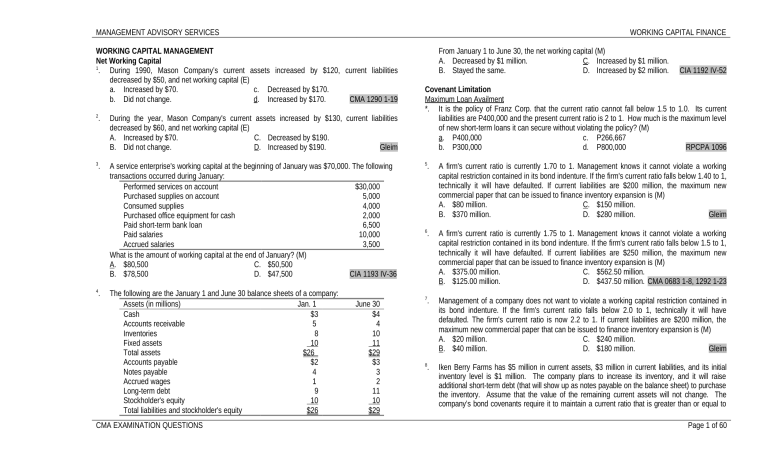

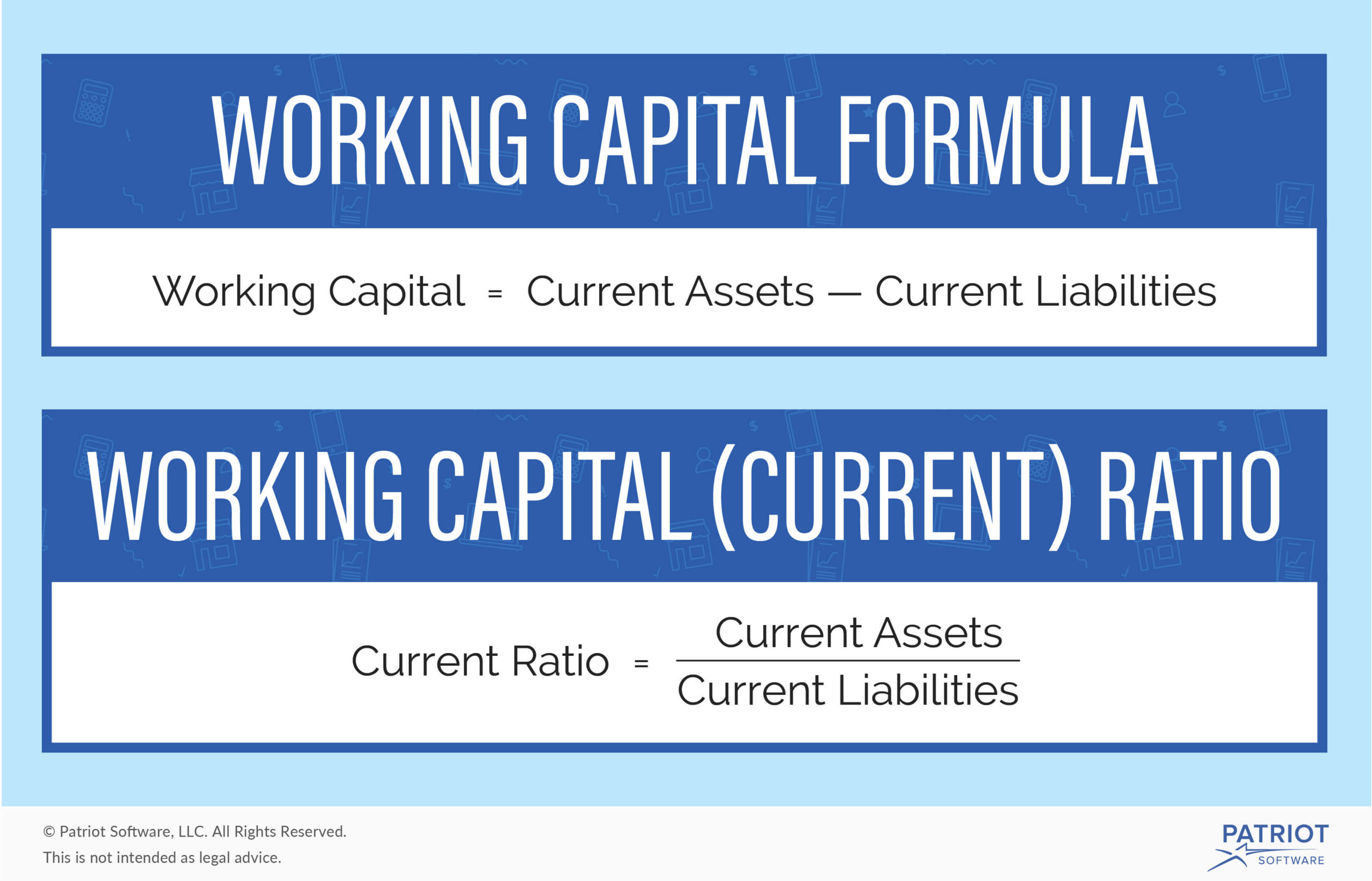

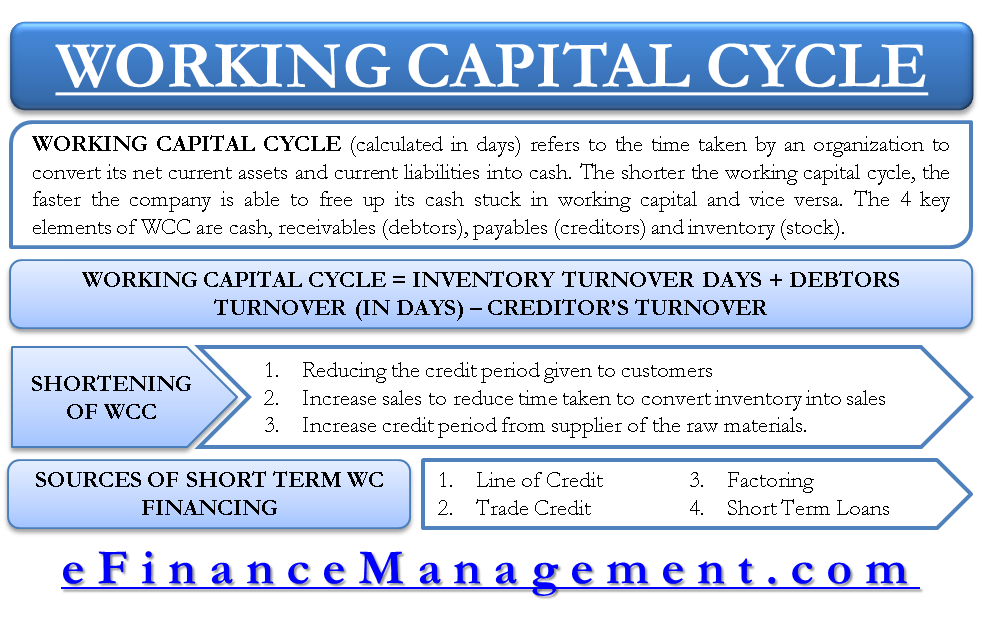

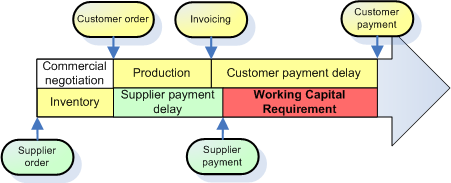

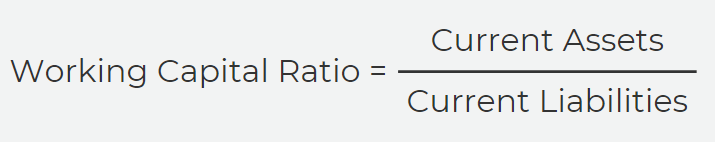

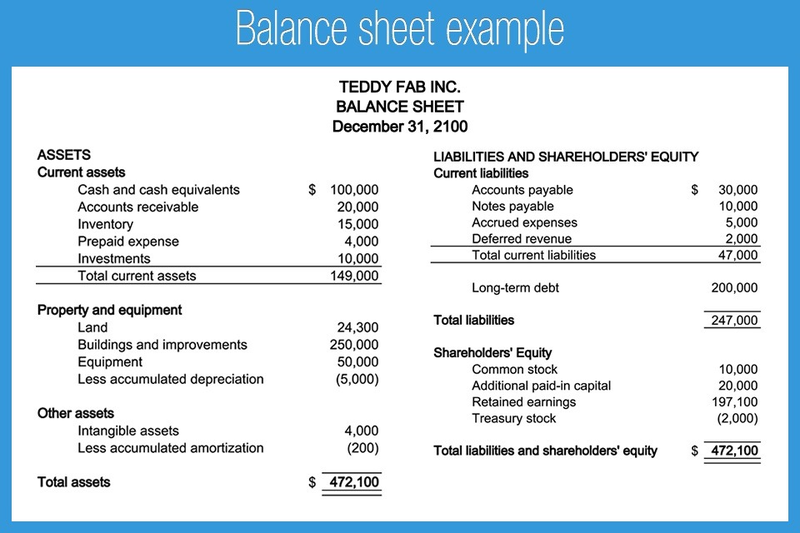

The working capital cycle is the time duration between paying for raw materials and goods that were bought to manufacture products and the final receipt of cash that you earn on selling the products So basically, it denotes the time required by your business operations to convert the current assets and current liabilities into cash Working capital is calculated by using the current ratio, which is current assets divided by current liabilities A ratio above 1 means current assetsThe working capital formula is Working Capital = Current Assets – Current Liabilities The working capital formula tells us the shortterm liquid assets available after

Working Capital is an essential metric in financial analysis, as it shows creditors and potential investors if the company can pay its shortterm payables within one year The Usefulness of Working Capital Many entrepreneurs believe that capital is one of the most useful figures that can be extracted from a balance sheet Understanding the meaning of working capital can help your company make important decisions such as How to adjust your level of capital use in response to changes in your business cycleWorking Capital (Net Current Assets) By adding together the totals for current assets and current liabilities in the balance sheet, a very important figure can be calculated – working capital Working capital provides a strong indication of a business' ability to pay is debts Every business needs to be able to maintain daytoday cash flow

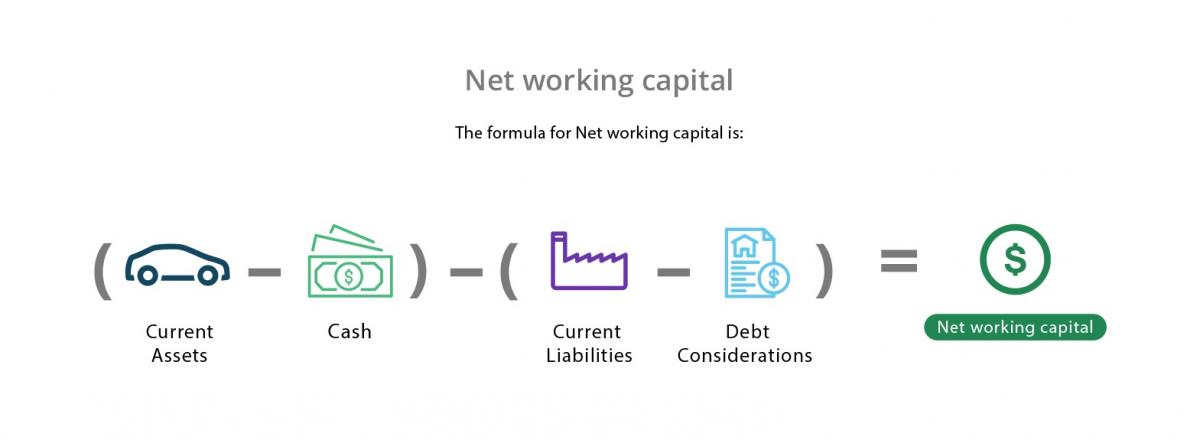

Net Working Capital Ratio Formula = Net Working Capital/Total Assets = (Current Assets – Current Liabilities)/Total Assets This ratio indicates the amount of funds invested in fixed assetsThe working capital ratio is calculated simply by dividing total current assets by total current liabilities For that reason, it can also be called the current ratio It is a measure of liquidity, meaning the business's ability to meet its payment obligations as they fall dueNet working capital – this is what people generally mean when they talk about working capital;

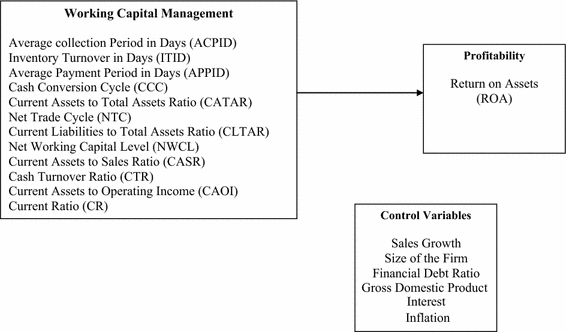

Working Capital Management

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Working Capital Ratio = Current Assets ÷ Current Liabilities Generally speaking, it can be interpreted as follows If this ratio around 12 to 18 – This is generally said to be a balanced ratio, and it is assumed that the company is a healthy state to pay its liabilitiesWorking capital (abbreviated WC) is a financial metric which represents operating liquidity available to a business, organization, or other entity, including governmental entities Along with fixed assets such as plant and equipment, working capital is considered a part of operating capital Gross working capital is equal to current assets For the experienced seller and their team, terms and conditions of the deal can be just as critical as the purchase price One of those key terms is called the working capital target In accounting terms, working capital is equal to current assets minus current liabilities

Working Capital

Treasury Essentials The Cash Conversion Cycle The Association Of Corporate Treasurers

A Brief Understanding of Working Capital As It Pertains to Your Business The Basic Formula It has been said that the lifeblood of any business is its net working capital (WC) The simplest explanation of this figure is the formula WC = Current assets – Current liabilitiesNet working capital is a liquidity calculation that measures a company's ability to pay off its current liabilities with current assets This measurement is important to management, vendors, and general creditors because it shows the firm's shortterm liquidity as well as management's ability to use its assets efficientlyNormalized Working Capital definition Normalized Working Capital means the negative amount equal to () €3,238,850 ( minus three million, two hundred and thirty eight thousand, eight hundred and fifty euros ) Normalized Working Capital means, with respect to any Person as of any date, the average level of net

Working Capital

Operating Working Capital Owc Financial Edge

If you have current assets of $1 million and current liabilities of $500,000, your working capital ratio Excess working capital carries the 'carrying cost' or 'interest cost' on the capital lying unutilized Shortage of working capital carries 'shortage cost' which include disturbance in production plan, loss in revenue etc Finding the optimum level of working capital is the main goal or winning situation for any business managerCalculating the Acceptable Level of Working Capital Cash and cash flow are critical to the health and viability of any company When companies generate sufficient cash flow from operations to

What Is Net Working Capital How To Calculator Nwc Formula

How To Calculate Working Capital Requirement Plan Projections

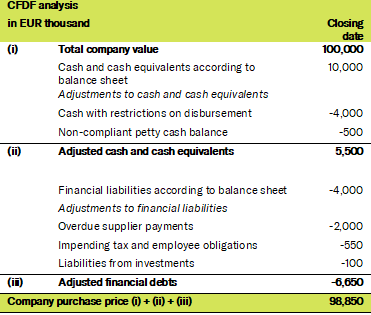

Normal level of net working capital The normal level of working capital is an amount defined in the purchase agreement and referred to as a net working capital target, a net working capital peg or net working capital true up The required level of working capital is generally calculated as the average of the last twelve months (LTM) Net working capital (NWC) is current assets minus current liabilities It's a calculation that measures a business's shortterm liquidity and operational efficiency It's also important for predicting cash flow and debt requirements Net working capital is also known simply as "working capital" NWC is a way of measuring a companyInto account in the working capital analysis (for example, deferred revenue or liability reserves) As part of the working capital adjustment, it is necessary to calculate a target working capital This represents the normalised level of working capital of the target business before the closing, on which the parties have agreed It also represents

Net Working Capital Formulas Examples And How To Improve It

Working Capital Examples And Calculation Formula The Ratio Of Own Working Capital

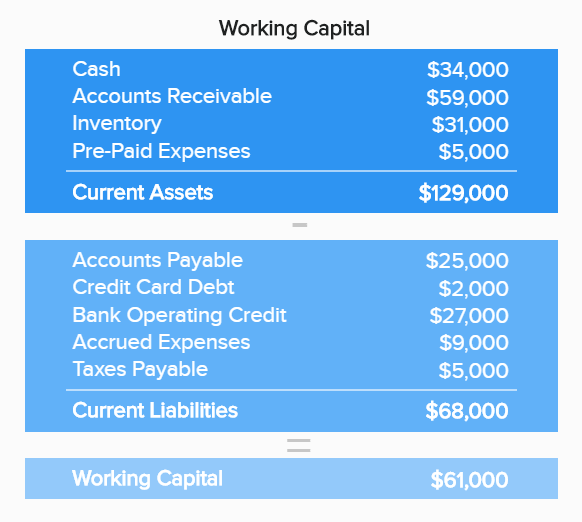

Formula Net Working Capital = Current Assets (less cash) – Current Liabilities (less debt) or, NWC = Accounts Receivable Inventory – Accounts Payable The first formula above is the broadest (as it includes all accounts), the second formula is more narrow, and the last formula is the most narrow (as it only includes three accounts) Working Capital Turnover Formula To calculate the ratio, divide net sales by working capital (which is current assets minus current liabilities) The calculation is usually made on an annual or trailing 12month basis, and uses the average working capital during that periodTo determine what a "normal" level is for NWC, an average of the previous six to 12 months is often used, which may be referred to as the "target" or "peg" At closing, the actual NWC delivered is compared to an agreedupon target and a "trueup" then occurs

Working Capital Ratio Formula Examples Calculation Youtube

Working Capital Formula Calculator Excel Template

Working capital is only adjusted if, at closing, it is above or below the target working capital by a set amount, for example, $250,000 Conclusion The white paper, " Negotiating Working Capital Targets and Definitions " is a great resources to explain the intricacies of one of the most argued areas in selling a businessWorking capital is the amount of money a company has left over after subtracting current liabilities from current assets Working capital tells you if a company can pay it's shortterm debts and have money left over for operations and growth Working capital should be used in conjunction with other financial analysis formulas, not by itselfThe following points highlight the top three methods of working capital estimation The methods are 1 Percentage of Sales Method 2 Regression Analysis Method 3 Operating Cycle Method 1 Percentage of Sales Method It is a traditional and simple method of determining the level of working capital and its components

P03 Working Capital Finance

Change In Net Working Capital Formula Calculator Excel Template

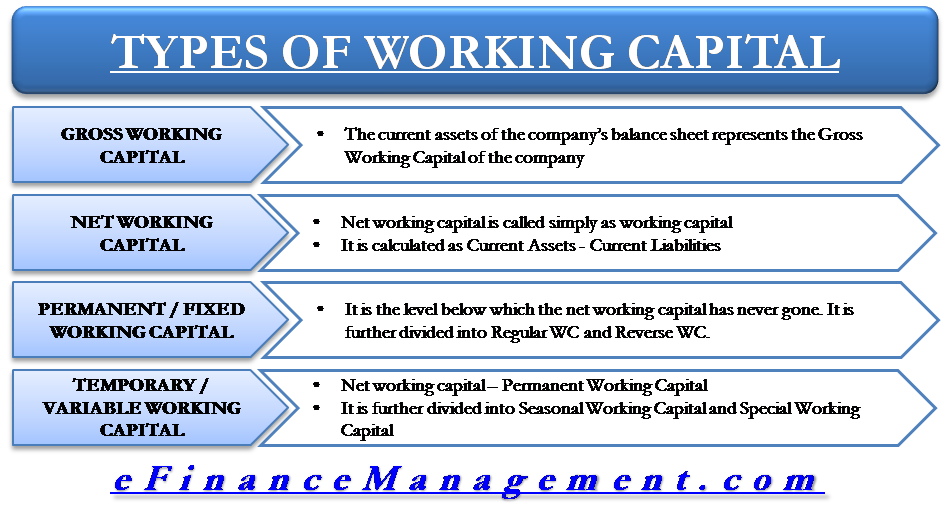

Currents assets minus current liabilitie s Permanent The amount of the working capital shall be maintained at such level, which is adequate for it to run its business operations, neither excessive nor inadequate This level of working capital is called as the "Optimum Working Capital" Liquidity Vs Profitability The level of working capital affects the degree of risk and profitability bothInventory to Working Capital Ratio Formula $$\text{Inventory to Working Capital} = \dfrac{Inventory}{Working\ Capital}$$ Working capital is calculated by subtracting current liabilities from current assets This is represented by combining the accounts receivable and inventories, less accounts payable

3

Longterm Capitals

In this ratio working capital is defined as the level of investment in inventory and receivables less payables In exam questions you may have to assume that yearend working capital is representative of the average figure over the year The sales to working capital ratio indicates how efficiently working capital is being used to generate salesHow do I calculate my working capital ratio?For example, if current assets are $1M and current liabilities are $750k then net working capital is $250k and the working capital ratio is 133 In this case there is positive working capital If current liabilities are greater than current assets then the company is said to have negative working capital

What Is Permanent Working Capital

Adjusted Working Capital Definition Formula Example

Formula The working capital ratio is calculated by dividing current assets by current liabilities Both of these current accounts are stated separately from their respective longterm accounts on the balance sheet This presentation gives investors and creditors more information to analyze about the company Current assets and liabilities are How is net working capital determined? Working capital is calculated by taking a company's current assets and deducting current liabilities For instance, if a company has current assets of $100,000 and current

Assessment And Computation Of Working Capital Requirement

Change In Working Capital Video Tutorial W Excel Download

Negotiating working capital targets and definitions Prepared by Robert Moore, Partner, RSM US LLP bobmoore@rsmuscom, 1 847 413 6223 The textbook definition of working capital is the difference between current assets and currentThis guide will discuss the net working capital formula, relevant resources, case studies, negative working capital, and mistakes to avoid Net working capital formula The simple formula for net working capital is current assets – current liabilities This formula At a high level, the calculation of working capital is as follows Current assets Current liabilities = Working capital The working capital figure will likely change every day, as additional accounting transactions are recorded in the accounting system

Operational Level Paper F 1 Financial Reporting Taxation

Changes In Working Capital Fcf And Owner Earnings

Change in Net Working Capital = Net Working Capital for Current Period – Net Working Capital for Previous Period Change in Net Working Capital = 12,000 – 7,000 Change in Net Working Capital = 5,000 NWC = Inventories Account Receivables Bank Balance Cash Balance – Accounts Payables For smoothly running the business operating cycle, it is necessary to pay our obligations when due, satisfy the customer as and when a need arises, andYou can get a sense of where you stand right now by determining your working capital ratio, a measurement of your company's shortterm financial health Working capital formula Current assets / Current liabilities = Working capital ratio;

Working Capital What It Is And How To Calculate It Efficy

Working Capital Formula Runningface

Net working capital requirement = Inventory Accounts receivable – Accounts payable This requirement to find the finance to fund inventory and accounts receivable is an issue for any business, but can be a major cause of concern for a high growth start up business

Types Of Working Capital Gross Net Temporary Permanent Efm

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

What Is Working Capital Meaning Definition Formula Management Net Working Capital And Example

/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)

Working Capital Definition

Working Capital Cycle Understanding The Working Capital Cycle

How To Calculate Working Capital Requirement Plan Projections

The Ins And Outs Of Business Working Capital Calculation Examples

Working Capital What It Is And How To Calculate It Efficy

Working Capital Turnover Ratio Meaning Formula Calculation

Estimating Working Capital Requirements Solved Problems Finance Strategists

What Is Working Capital How To Calculate And Why It S Important Netsuite

Working Capital Management Acca Global

M A Vocabulary Explained By The Experts Cash Free Debt Free Rodl Partner

Chapter 4 Working Capital Ppt Download

Working Capital Requirement a Mantra

Working Capital Management Businance

How To Calculate Working Capital Guide Formula Examples

M5 Partnerships Book Pages 251 276 Flip Pdf Download Fliphtml5

Gross Working Capital And Net Working Capital

How To Calculate Working Capital The Working Capital Formula

Free Up Cash Manage Working Capital Strategic Finance

Net Working Capital Definition Berechnung Beispiel Mit Video

Working Capital Formula How To Calculate Working Capital

Working Capital Formula Calculations Examples And Tips India Dictionary

/how-to-calculate-working-capital-on-the-balance-sheet-357300-color-2-d3646c47309b4f7f9a124a7b1490e7de.jpg)

What Is Working Capital

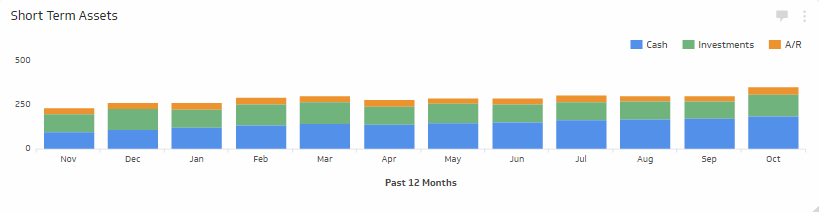

Working Capital Financial Kpi Examples Klipfolio

Working Capital Cycle

1

1

Working Capital Definition Formula Examples With Calculations

Working Capital Example Meaning Investinganswers

What Is The Working Capital Formula Revenued

:max_bytes(150000):strip_icc()/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)

What Changes In Working Capital Impact Cash Flow

1

Management Financing Of Working Capital Ppt Download

Working Capital Net Current Assets Tutor2u

Nta Ugc Net Set Exams Working Capital Leverage And Mcqs Offered By Unacademy

4 Tips For Effectively Managing Working Capital Softco

Working Capital In Valuation

7 Management Of Working Capital Pdf Free Download

Net Working Capital Guide Examples And Impact On Cash Flow

Working Capital Financial Edge

Curve Estimation Regression Models Between The Level Of Working Capital Download Scientific Diagram

Working Capital Meaning Ratio Example Formula Cycle

Days Working Capital Formula Calculate Example Investor S Analysis

What Is Working Capital Meaning Definition Formula Management Net Working Capital And Example

The Working Capital

Back To Basics Working Capital Workful

What Is Net Working Capital How To Calculate Nwc Formula

Working Capital Definition Formel Und Berechnung Mit Video

:max_bytes(150000):strip_icc()/NetWorkingCapital-4f7d2474ee2242c8a1f82b714cb68315.png)

Net Working Capital What Is It

Working Capital Management Businance

17 Level I Cfa Corporate Finance Working Capital Summary Youtube

Working Capital Example Formula Wall Street Prep

Net Working Capital Formulas Examples And How To Improve It

/how-to-calculate-working-capital-on-the-balance-sheet-357300-color-2-d3646c47309b4f7f9a124a7b1490e7de.jpg)

What Is Working Capital

Working Capital Requirement a Mantra

Working Capital Meaning Formula Example Accountingcapital

The Determinants Of Working Capital Management And Firms Performance Of Textile Sector In Pakistan Springerlink

Pdf Balance Sheet Ratios And Analysis For Cooperatives Abilash Sjr Academia Edu

Working Capital Formula Youtube

Change In Net Working Capital Formula Calculator Excel Template

How To Calculate Working Capital With Calculator Wikihow

Working Capital Ratio Analysis Example Of Working Capital Ratio

Working Capital Meaning Ratio Example Formula Cycle

Working Capital Management Acca Global

Net Working Capital Calculation Dilemma Lutz M A Solutions

A Small Business Guide To Calculating Net Working Capital The Blueprint

Financial Kpis Metrics See The Best Finance Kpi Examples

How To Calculate Working Capital The Working Capital Formula

Working Capital Formulas And Why You Should Know Them Fundbox

Change In Working Capital Video Tutorial W Excel Download

Chapter 7 Working Capital Management

How To Calculate Working Capital With Calculator Wikihow

Changes In Working Capital Fcf And Owner Earnings

Chapter 2 Working Capital Sreyya Yilmaz Ra Working

Working Capital Example Formula Wall Street Prep

Working Capital Example Formula Wall Street Prep

How To Calculate Working Capital With Calculator Wikihow

Working Capital What Is It And Why It S Important

0 件のコメント:

コメントを投稿